New research: Pay ratio disclosures provide insights into low pay

15 December 2020A report published today by the High Pay Centre think tank and the Standard Life Foundation provides new insights into the pay practices of some of the UK’s biggest businesses.

The report is based on new pay ratio disclosures, published in 2019/20 for the first time, following rules requiring listed companies with over 250 UK employees to disclose their CEO’s pay relative to the upper quartile, median, and lower quartile pay of their UK workforce.

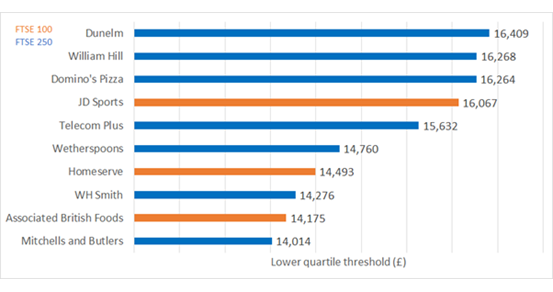

Analysis of the disclosures found that low levels of pay are widespread across the FTSE 350:

- 36 companies – 18% of the sample – pay at least a quarter of their employees less than £20,000 a year (on an fte basis).

- Of these, 34 companies pay all lower quartile employees below the annualised equivalent of the London Living Wage (£19,565), while 11 pay below the annualised equivalent of the Real Living Wage (£16,926).2

1 Pay ratio disclosures show annual earnings for the upper quartile, median and lower quartile employee of each company on a ‘full time equivalent’ basis. On the basis of a 35 hour week, we have taken £19,565 as the annualised equivalent of the London Living Wage of £10.75 in 2019/20. At 34 companies, at least 25% of their UK employees (ie including those outside London) earn less than this amount

2 On the same basis that we have annualised the real living wage, an annualised equivalent of the statutory minimum wage for over 25s would be £14,492 - however there is no suggestion that any companies in our sample have breached the minimum wage requirements. Factors that could potentially drive pay levels below an annualised minimum wage equivalent include the employment of large numbers of workers below the age of 25, and the use of the Coronavirus Job Retention Scheme, whereby workers receive only 80% of their pay.

FTSE 350 companies with the lowest pay levels at the 25th percentile point of their UK workforce (on an FTE basis)

The median CEO/median employee pay ratio across the FTSE 350 was 53: 1 and the median CEO/lower quartile employee ratio was 71: 1. These ratios are significantly higher for the FTSE 100, where the median CEO/median ratio was 73: 1 and the median CEO/lower quartile ratio was 109: 1.

The highest pay ratios were at Ocado, with a large incentive scheme payout to their CEO in 2019/20 resulting in a 2,605: 1 ratio between the CEO and the median employee, and a 2,820: 1 gap between the CEO and the lower quartile. The next highest CEO to median employee ratio was 310: 1 at JD Sports, while the second highest CEO to lower quartile gap was the 543: 1 recorded by BP.

The lowest ratios were at asset management firm Sanne Group, where the CEO/median CEO/lower quartile ratios were 8: 1 and 13: 1 respectively.

10 highest CEO/median employee ratios

| Company | Index | Industry | CEO/median employee ratio |

|---|---|---|---|

| Ocado |

100 | Retail | 2,605 |

| JD Sports | 100 | Retail | 310 |

| Tesco | 100 | Retail | 305 |

| Watches of Switzerland | 250 | Retail | 262 |

| GVC Holdings | 100 | Travel & Leisure | 229 |

| Morrisons | 100 | Retail | 217 |

| CRH | 100 | Construction & Materials | 207 |

| WH Smith | 250 | Retail | 207 |

| Astra Zeneca | 100 | Health Care | 190 |

| Serco | 250 | Industrial Goods & Services | 19 |

10 highest CEO/lower quartile employee ratios

| Company | Index | Industry | CEO/median employee ratio |

|---|---|---|---|

| Ocado | 100 | Retail | 2,820 |

| BP | 100 | Oil & Gas | 543 |

| Tesco | 100 | Retail | 355 |

| JD Sports | 100 | Retail | 348 |

| Watches of Switzerland | 250 | Retail | 317 |

| CRH | 100 | Construction & Materials | 289 |

| Astra Zeneca | 100 | Health Care | 280 |

| GVC Holdings |

100 | Travel & Leisure | 278 |

| Homeserve | 100 | Retail | 278 |

| Experian | 100 | Industrial Goods & Services | 267 |

Even within industries, there were sizeable differences between companies. In the retail sector, lower quartile pay at companies whose pay-setting process involves union consultation and/or full collective bargaining agreements, did not fall below £18,000, and the average lower quartile threshold was £18,85.

At companies without full collective bargaining coverage, some lower quartile thresholds were below £15,000 and the average was £17,661.

The report notes that the pay ratio disclosures probably understate the extent of low paid work at major UK companies, as indirectly employed workers often in low-paid roles including catering, security or facilities management are not included in the calculations. It makes a number of recommendations including:

- Expanding the application of pay ratio reporting requirements to cover large employers beyond listed companies, and expanding the reporting requirements to cover indirectly employed workers.

- Requiring more detailed reporting on high earners between the top quarter and the CEO, potentially enabling better understanding of the potential to redistribute pay from a small number of very highly paid employees to low- and middle- income earners.

- Requiring companies to disseminate their pay ratios directly to employees in an annual update, to give workers a better understanding of where they are situated in the company pay structure and enable them to make an informed judgement on the fairness of their pay.

High Pay Centre Director Luke Hildyard said:

“Pay ratio disclosures provide a valuable new insight into the corporate cultures and working practices of some of the UK’s biggest employers.

“These findings show that quite low levels of pay are commonplace for large numbers of workers at many of our major companies.

“Hopefully the disclosures can help investors, policymakers and of course the companies themselves think more deeply about how to improve fairness at work, and pay for low-paid workers in particular.”

Standard Life Foundation Chief Executive Mubin Haq said:

“Today’s report highlights the vast differences in pay amongst UK companies, with one CEO earning nearly three thousand times more than the company’s lowest quartile employee. It needn’t be this way. There is great potential for rethinking pay, benefitting those on lower incomes.

Nowhere is this more stark than in the retail sector which has the highest levels of inequality. During the pandemic the industry either relied heavily on government support or made significant profits. Rewards are not being fairly shared but companies can begin to make plans to reduce the gaps that exist.”

Analysis of 2020 pay ratio disclosures (interim report)

Notes to editors

- Pay ratio reporting requirements - which came into effect in 2019, meaning that mandatory disclosures began to appear in annual reports from 2020 - stipulate that companies must publish a table in their annual remuneration report showing CEO pay relative to pay at the 75th, median and 25th percentile of the company’s UK employees. That is to say, if all the company’s UK employees were ranked from highest to lowest in terms of their total pay (on a full time equivalent basis) how would the CEO’s pay compare to the thresholds for the upper quartile (i.e. the 75th percentile, earning more than 75% of employees), the median (exactly in the middle of the ranking) and the lower quartile (the 25th percentile, earning more than 25% of UK employees).

- This report is based on analysis of all the FTSE 350 companies to provide pay ratio disclosures prior to 30 November 2020. Over the time period covered, a total of 186 FTSE 350 companies covered by the pay ratio reporting requirements (78 from the FTSE 100 and 108 from the FTSE 250) published annual reports in which pay ratios were disclosed. This excludes closed-end investment funds and companies with under 250 UK employees. In addition to these mandatory disclosures, we have included some voluntary disclosures. 15 companies which have not yet published their annual reports made voluntary disclosures in 2019. This brings the total number of disclosures up to 201, which represents over 90% of companies that are required to disclose.

- Annualised equivalents of the London and real (UK) living wage are based on a 35-hour week at the 2019/2020 rates of £10.75 (London) and £9.30 (UK). The real living wage is a voluntary accreditation set by the Living Wage Foundation, based on their calculation of what is necessary to secure a decent standard of living. It should not be confused with the statutory minimum wage (also known as the National Living Wage).